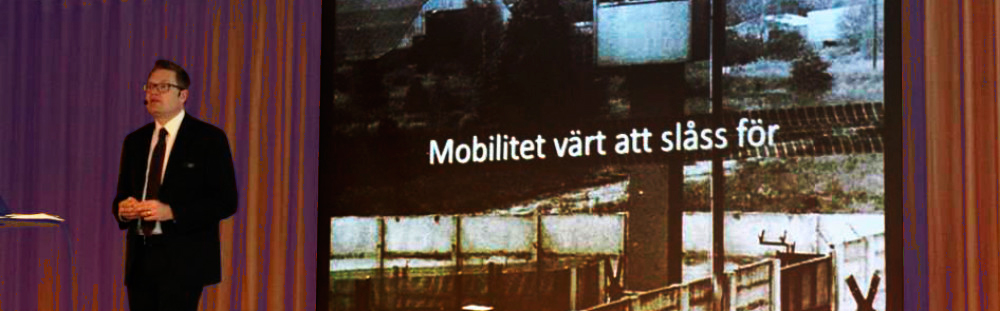

Was Heckscher Right About Monopolies on Communications in 1921? Already in the 1920s Eli Heckscher feared monopolized mobility.

Was Heckscher Right About Monopolies on Communications in 1921? Already in the 1920s Eli Heckscher feared monopolized mobility.

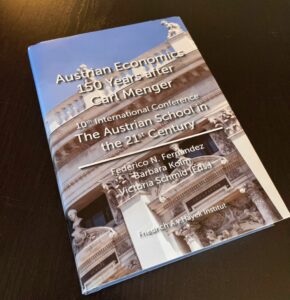

My paper about how current threat to free mobility is not a new thing is published in this anthology. Austrian Economics 150 Years after Carl Menger. The book can be ordered from the Friedrich August von Hayek Institut and from Hugendubel.

Read my paper here 211103 Ydstedt_Austrian-Conference-Vienna.